- #Simple accounting software for bills and checks Offline#

- #Simple accounting software for bills and checks free#

You'll have to make sacrifices, but if it's guidance you need, this sets itself apart from the likes of Quicken. If you get off track, YNAB – which is reasonably forgiving and understanding for a bit of software – will tell you what you need to do to get back to where you need to be.

It's quick to install, supports the majority of transaction information downloadable from banks, and appropriately configures itself for personal or small business use by changing its monetary categories depending on your needs.

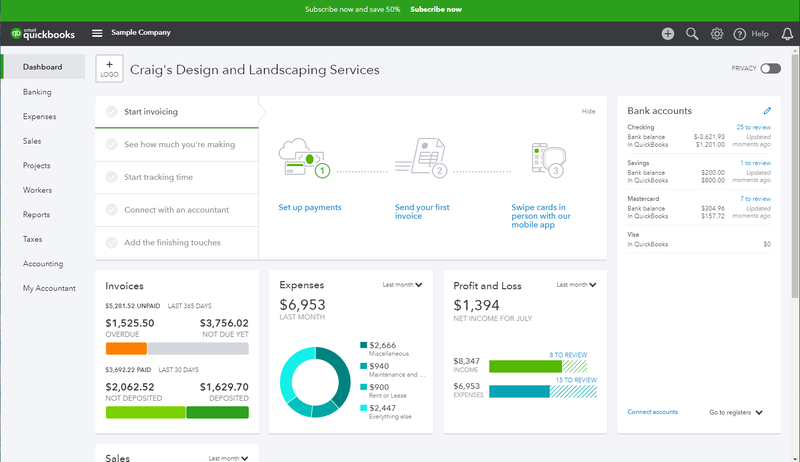

Stick to the program, temper your spending appropriately, and eventually YNAB will see you spending last month's money rather than that which you've just earned. YNAB's primary mission, as you might expect, is to help you curb overspending and avoid living from paycheck to paycheck. And perhaps you have more money than you thought? Because, hey, if you don't want to spend every single penny you have and more, you absolutely do need one. Just in case you need to be told explicitly what to do, along comes YNAB - short for You Need A Budget. This means you have a clear idea of how much your savings and investments are worth, though it's fair to say you shouldn't panic about short-term fluctuations in the stock market.Īltogether, Quicken brings together your budgeting, banking, and investment reporting into a single dashboard, which you can view from your desktop or even via your cell phone from the mobile app. This is especially handy as people easily underestimate how much regular small purchases can add to costs.įor investments it also offers the ability to track these, whether as part of your savings, investment portfolio, or 401k pension plan. For accounting purposes you can even bring your banking and credit card bills together in one place so that you have a very clear idea indeed of how much you're paying out. In terms of bills, you can also see which utilities and similar you are constantly paying out to, and see both the amounts to be paid and how much money you have left over. For budgeting, it offers you a chance to input your purchases and income so you can compare them both together to get a better idea of how much you are spending compared to how much you are earning. These are set around a few different areas, namely budgeting, bills, accounts, and even investments. Quicken offers a good range of financial reporting tools. Quicken is a long-established tool for managing personal accounts, and while its reputation was built on a desktop version, it's now available to run as an app on your mobile devices. Cloud-based personal finance packages let you keep all of your data in a safe place too, so all bases are covered.

#Simple accounting software for bills and checks Offline#

There are personal finance packages tailored to both online and offline needs, with many having apps that let you track spending day to day. That means you'll be much better placed when it comes to tax filing time. The other bonus is that most of the personal finance software packages allow you to share your data with your preferred tax and accounting software. Depending on your needs you'll find that the best personal finance packages allow you to keep on top of things like receipt logging and managing expenses, all from within one program.

:max_bytes(150000):strip_icc()/quickbooks-cad782438200444a873b2cad5e1c8c52.png)

If you're in need of some organisational clout, especially if you're running a small business, picking a personal finance software package can help a great deal. What to consider with personal finance software

#Simple accounting software for bills and checks free#

Here then are the best personal finance software platforms currently available and, underneath those, the best free personal finance software.

0 kommentar(er)

0 kommentar(er)